Managing your money is not all about doing very good maths, and account on how you are going to spend on all items. Sometimes, your requirements are bigger than your capacity. But that doesn’t mean, you have to give up on all your wishes and live a simple life, with no sense of living life. Well, get yourself registered for payday and see how you can live your life more appropriately and luxuriously. All you have to do is follow a few tips and see how you can increase your budget for shopping for your favourite items.

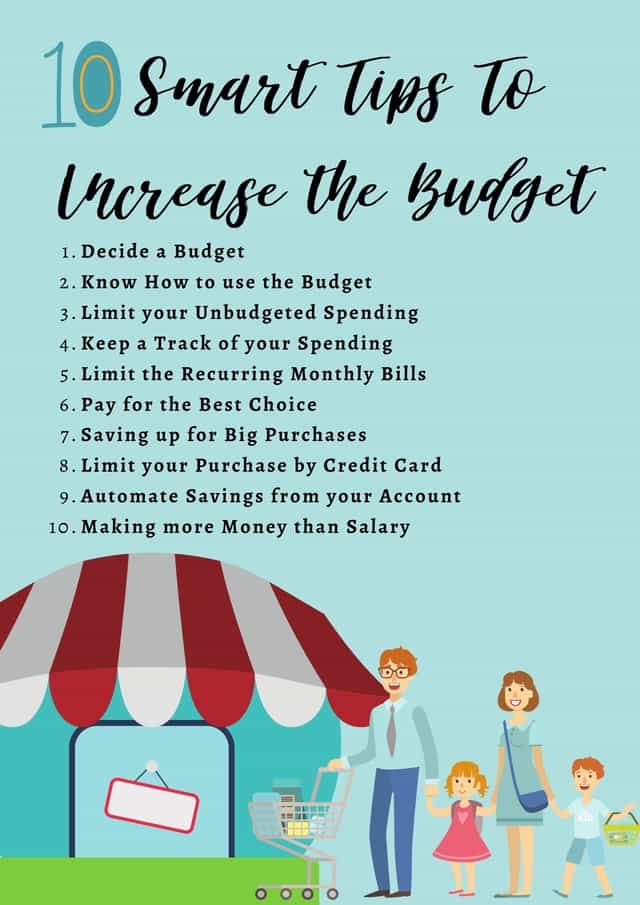

1. Decide a Budget

You must sit with a budget and a ’to do’ list. Say you want to buy something, then you can add to your budget guessing that spending will be more the particular month. If you don’t want to focus on your budget, make sure that budgeting has great advantages. Strike off those points which you feel could be unnecessary expenditures, and add a bit to your savings plan. You may register yourself for the online payday loans Nevada. This is a short term loan, often known as a cash advance at certain times.

2. Know How to use the Budget

There are various categories in your spending’s like- recurring and one-time expenses. You may list the recurring expenses and then decide what to but in large one time investments, so that your limit is not strained. Opt for the 24 hours payday loans in Las Vegas, and you will come to know how to finance your microbusiness. You may also organize your payday loans for traveling. There are various advantages of a payday loan, which can be counted as:

- Managing emergency funds effectively.

- There is a high possibility of being approved.

- The loan amounts are flexible.

- There is an increased level of dependability.

- This is the best alternative for an unsecured loan.

- There is no loan approved on credit.

3. Limit your Unbudgeted Spending

Suppose, you are having an excess of money at the end of the month, make sure you don’t spend that unnecessarily. If you are planning to buy something big and good, the rest should be kept as savings. In fact, buy things that will be useful and opt for the payday loans Las Vegas no credit check.

4. Keep a Track of your Spending

Start tracking your expenditure for a month. Keep a noting on them and categorize as which could be avoided or might you have overspent. If you see, you have overdone in certain areas, try to control in the next month. With a payday loan scheme, you can always have more than you actually need, but try to curtail unnecessary expenditure, since the loan amount has to be paid from your pay check.

5. Limit the Recurring Monthly Bills

Maybe you have been granted a loan from your paycheck, but that doesn’t mean you can do all unnecessary expenditures. Well, you can make a strategy to reduce some unnecessary recurring expenditure. Well, the decision is up to your discretion, what you feel is an unnecessary expenditure. Do not commit to any more recurring spending, that could probably reduce a portion of your payback amount. Checking unnecessary recurring spending is the most effective way to limit you. The loan is delivered to you based upon income, but if you have more expenditure, of course, the payback discourse will be affected.

6. Pay for the Best Choice

While you are making a buy, make sure that you pay for the cheapest price. Check for discounts and offer cards. Check multiple options to see that you get the cheapest and best deal out of a single purchasable item. Making the best purchase is possible, and you’ll realize that you have saved a lot.

7. Saving up for Big Purchases

While you are going for big purchases, make sure you are using the best credit card that allows you a discount. While you save a bit by credit card, you actually avoid paying that amount by debit card. The amount you save is just an addition to the amount you plan to pay back towards the amount of your loan.

8. Limit your Purchase by Credit Card

Credit cards are the best option when you are left with no money, and you want to limit your purchase. In fact, every credit card has some limits. The limit factor aids in developing a lesser spending habit. You will avoid all those unnecessary things that would just add to the junks of your house. You can practice to resist the urge to unnecessary expenditure and being flawed away by glittering ads.

9. Automate Savings from your Account

Opt for some good savings plan. Some recurring deposits that could be auto-debited from your account, and add to the number of fixed deposits. This is a very good practice and you can add to your savings. A part of it could be instrumental in paying your loans. Automated savings is always a good habit. Gain some interest and that is a benefit already.

10. Making more Money than Salary

Invest wisely, in fact, invest in short term fixed deposits and see your money multiply in the shortest possible time. Well, if you have opted for a loan by a paycheck, you would have more than what you want. Well, after the amount is deducted from your salary, try saving the rest in the wisest possible method. Develop the habit of spending money in a better way every time you receive your pay check.

Final Thoughts

Make a good study on all the categories of credit cards, especially those that can give better returns. There could be various offers, and cashback returns could be even bigger in cash. So, your financial planning depends a lot on how you select the payment mode of your purchase. Good saving habit comes with time, and especially how you purchase wisely and learn how to save your hard-earned money.